Some Known Incorrect Statements About Transaction Advisory Services

Wiki Article

How Transaction Advisory Services can Save You Time, Stress, and Money.

Table of ContentsSome Of Transaction Advisory ServicesOur Transaction Advisory Services PDFsGetting The Transaction Advisory Services To WorkMore About Transaction Advisory ServicesTransaction Advisory Services Can Be Fun For Everyone

This step makes sure the organization looks its ideal to possible purchasers. Obtaining the company's value right is essential for a successful sale.Transaction advisors step in to assist by getting all the needed details arranged, addressing questions from purchasers, and setting up check outs to the organization's location. Deal consultants utilize their knowledge to assist service owners take care of hard negotiations, fulfill customer assumptions, and structure deals that match the proprietor's objectives.

Meeting lawful regulations is vital in any service sale. Transaction advisory solutions collaborate with legal experts to produce and assess contracts, contracts, and various other legal papers. This lowers dangers and makes certain the sale adheres to the law. The function of deal consultants extends past the sale. They assist entrepreneur in intending for their next steps, whether it's retirement, beginning a new venture, or managing their newly found wealth.

Purchase experts bring a riches of experience and expertise, making sure that every facet of the sale is handled professionally. Through critical prep work, evaluation, and settlement, TAS helps local business owner attain the greatest feasible price. By ensuring lawful and regulative compliance and managing due diligence along with various other bargain staff member, deal consultants minimize potential dangers and obligations.

The Only Guide to Transaction Advisory Services

By comparison, Huge 4 TS groups: Job on (e.g., when a potential purchaser is carrying out due persistance, or when a bargain is closing and the buyer needs to integrate the business and re-value the seller's Equilibrium Sheet). Are with charges that are not connected to the deal closing efficiently. Gain fees per interaction someplace in the, which is much less than what financial investment banks earn also on "small offers" (however the collection possibility is additionally a lot higher).

The interview inquiries are really comparable to investment financial interview inquiries, but they'll concentrate much more on accountancy and valuation and less on subjects like LBO modeling. As an example, expect concerns regarding what the Modification in Capital ways, EBIT vs. EBITDA vs. Take-home pay, and "accounting professional only" topics like trial equilibriums and exactly how to go through events using debits and credit histories as opposed to financial declaration modifications.

Get This Report about Transaction Advisory Services

Specialists in the TS/ FDD teams may also speak with administration concerning everything above, and they'll create an in-depth report with their searchings for at the end of the process.The pecking order in Transaction Providers varies a little bit from the ones in investment financial and private equity jobs, and the general shape looks like this: The entry-level role, where you do a lot of information and monetary analysis (2 years for a promo from below). The next degree up; similar work, yet you obtain the more fascinating little bits (3 years for a promotion).

Specifically, it's difficult to get advertised beyond the Supervisor level since couple of individuals leave the job at that stage, and you need to begin showing evidence of your ability to produce earnings to breakthrough. Allow's start with the hours and way of living considering that those are easier to describe:. There are occasional late nights and weekend break job, however absolutely nothing like the frantic nature of financial investment banking.

There are cost-of-living changes, so anticipate reduced compensation if you're in a more affordable location outside major monetary (Transaction Advisory Services). For all settings except Companion, the base pay comprises the mass of the complete compensation; the year-end benefit could be a max of 30% of your base wage. Often, the best way click reference to increase your profits is to switch to a different firm and discuss for a greater income and bonus

Some Ideas on Transaction Advisory Services You Need To Know

You might obtain right into business advancement, yet investment financial gets more hard at this stage because you'll be over-qualified for Expert roles. Company financing is still an option. At this phase, you ought to simply remain and make a run for a Partner-level duty. If you intend to leave, possibly transfer to a customer and do their appraisals and due diligence in-house.The primary trouble is that due to the fact that: You generally need to sign up with another Huge 4 team, such as audit, and work there for a few years and after that move right into TS, job there for a few years and afterwards move right into IB. And there's still no guarantee of winning this IB function since it depends on your area, clients, and the employing market at the time.

Longer-term, there is likewise some threat of and because examining a firm's historical monetary information is not precisely brain surgery. Yes, humans will constantly need to be involved, but with even more advanced technology, reduced head counts can potentially support customer involvements. That said, the Deal Providers read here team beats audit in terms of pay, work, and departure chances.

If you liked this short article, you may be interested in analysis.

Some Known Incorrect Statements About Transaction Advisory Services

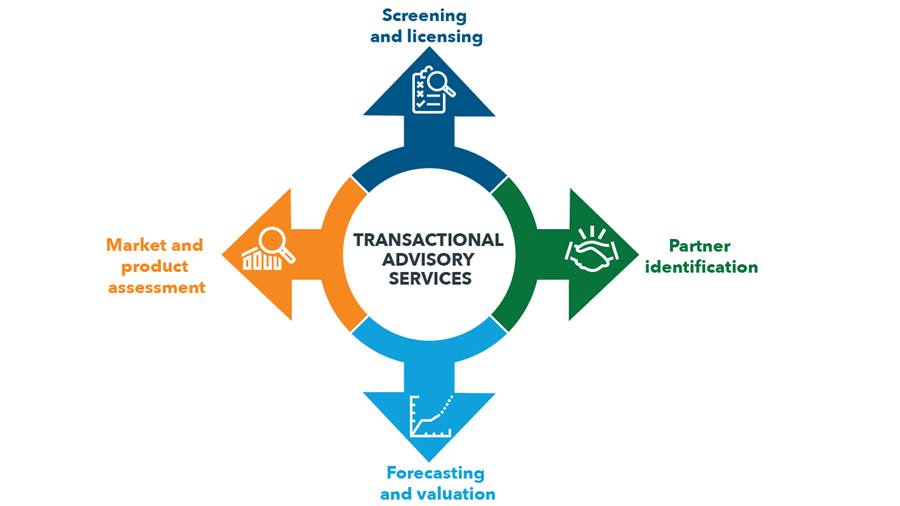

Create innovative monetary structures that aid in figuring out the actual market value of a firm. Give consultatory job in connection to company evaluation to help in negotiating and pricing frameworks. Discuss one of the most appropriate kind of the bargain and the type of consideration to utilize (cash, stock, gain out, and others).

Establish action plans for risk and direct exposure that have actually been determined. Execute combination planning to establish the process, system, and business changes that may be called for after the deal. Make numerical price quotes of integration expenses and advantages to assess the economic rationale of assimilation. Set guidelines for incorporating divisions, innovations, and organization procedures.

Analyze the potential consumer base, sector verticals, and sales cycle. The functional due diligence provides vital understandings right into the performance of the firm to be acquired worrying threat analysis and value creation.

Report this wiki page